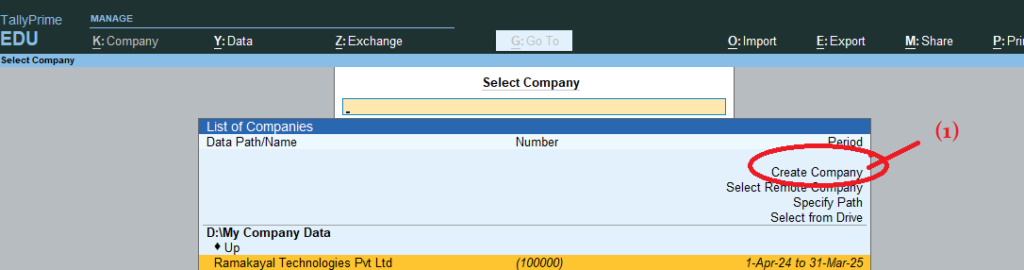

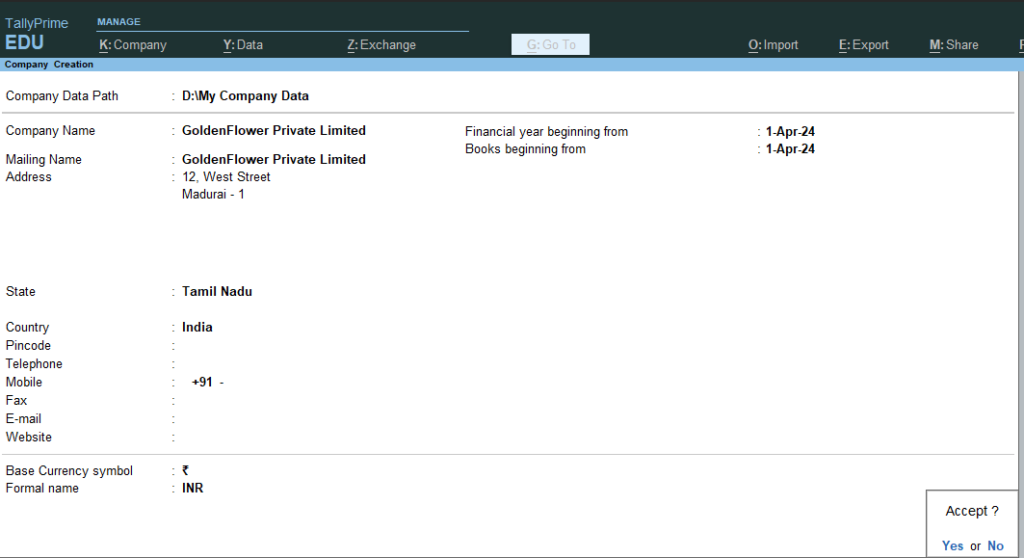

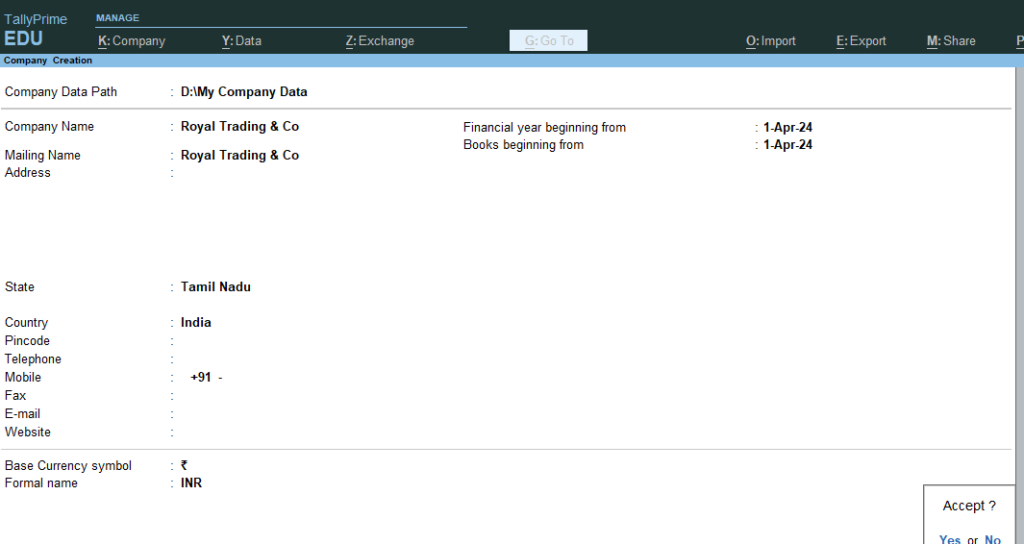

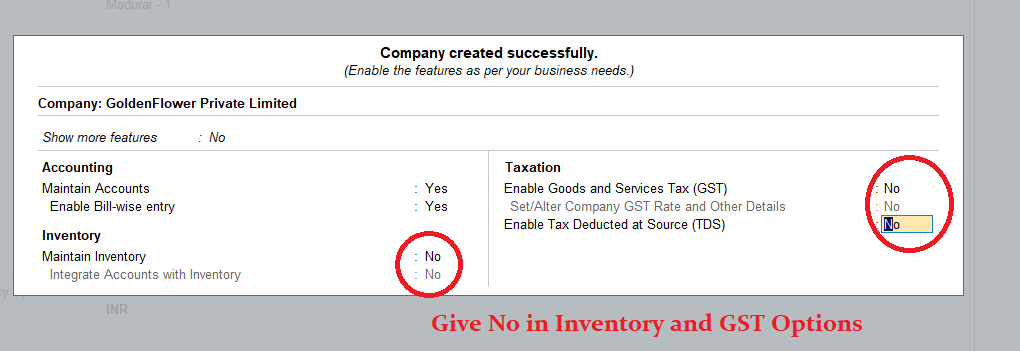

- First Create a new company named Royal Trading & Co

2. After Company Creation > First Create the following ledgers >

| Ledger Name | Group | Debit (₹) | Credit (₹) |

|---|---|---|---|

| Ramu Capital Account | Capital Account | | 10000 |

| Cash in Hand | Cash-in-Hand | 10000 | |

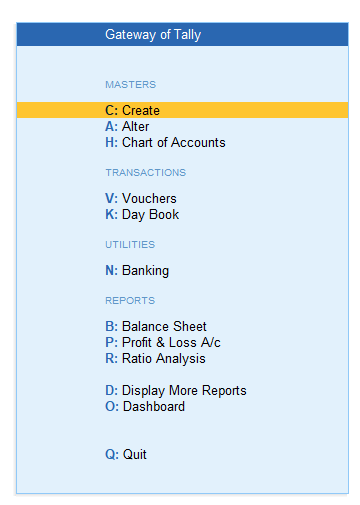

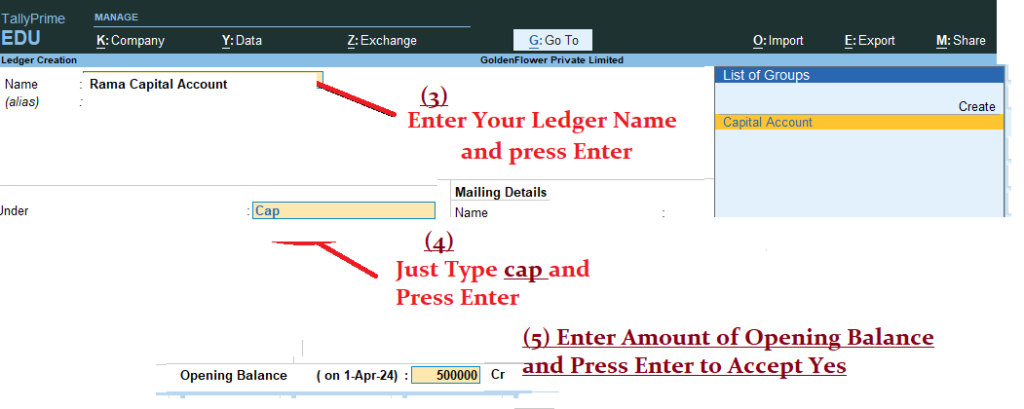

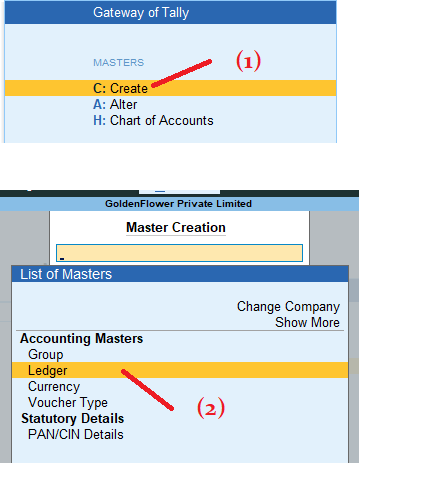

3. Gateway of Tally > Masters : Create > Ledgers:

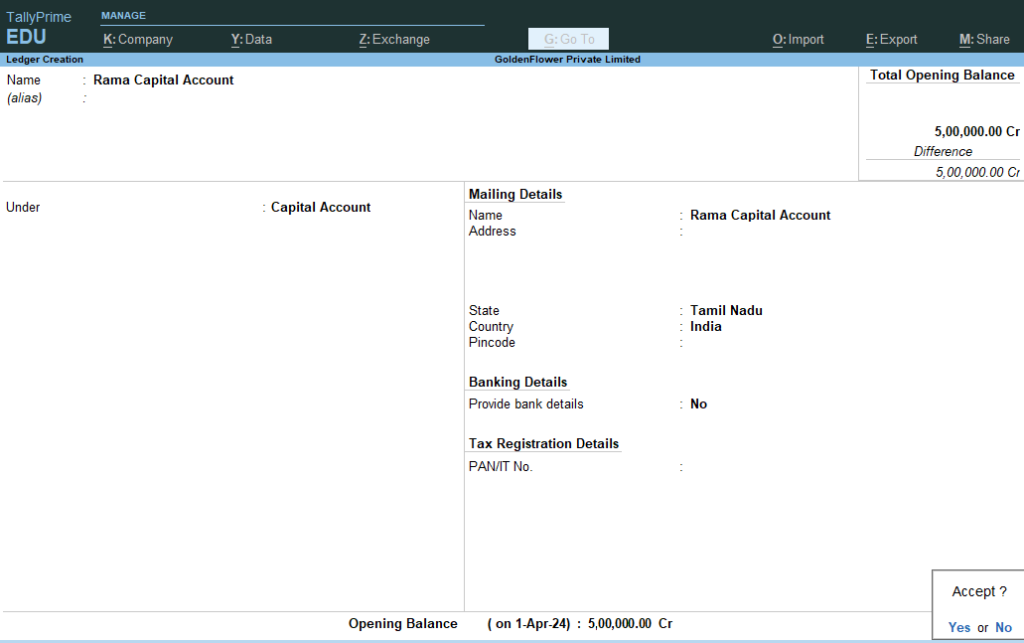

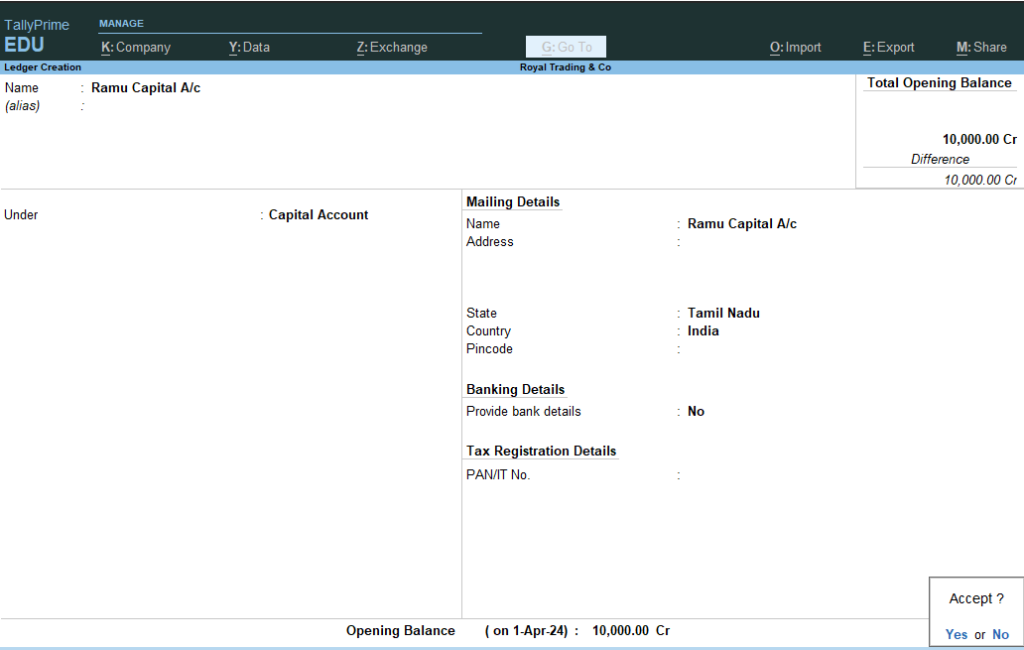

4. Enter Name : Ramu Capital A/c — Under : Type Cap and Select Right Side Using Arrow Keys or Select and Enter Capital Account > and Give Opening Balance : 10000 Cr. > Accept Yes >

5. Now you will see the Same Ledger creation > Press Escape twice and Goto Gateway of Tally >

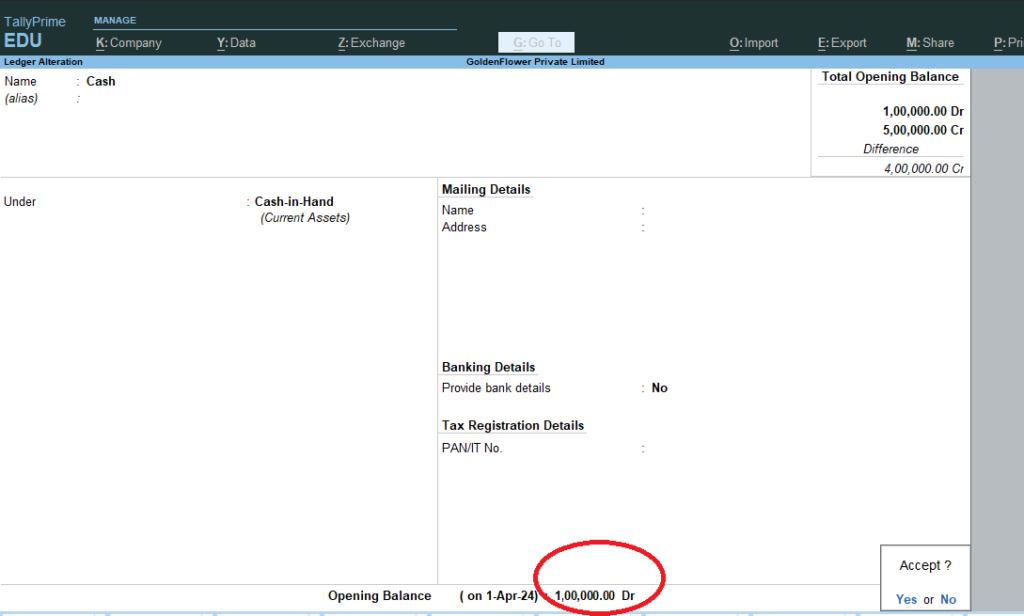

6. Gateway of Tally > Master : Alter > Ledgers > Select Cash > Opening Balance : 10000 Dr.

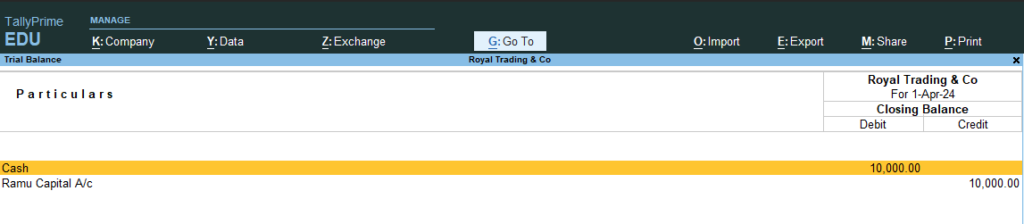

7. So Ramu is Giver and Cash is Comes in to Business . So Cr. Ramu Capital A/c and Dr. Cash A/c

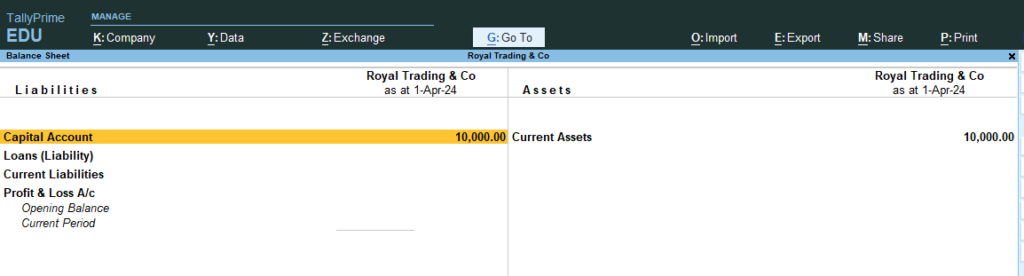

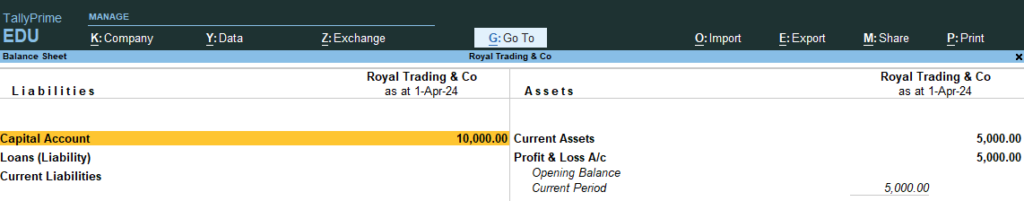

8. Go Gateway of Tally > Go Balance Sheet > You Can See Liabilities / Current Assets Statement

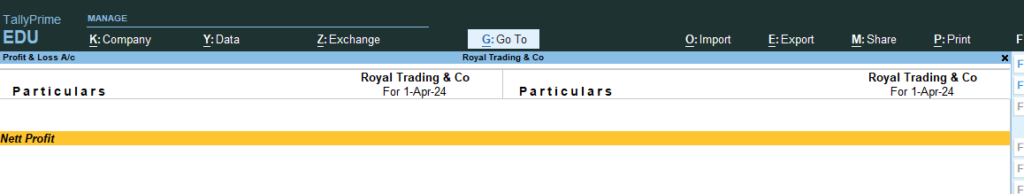

9. Go Gateway of Tally > Go Profit and Loss A/c > No Profit and Loss Data because no entry made in any purchase or sales

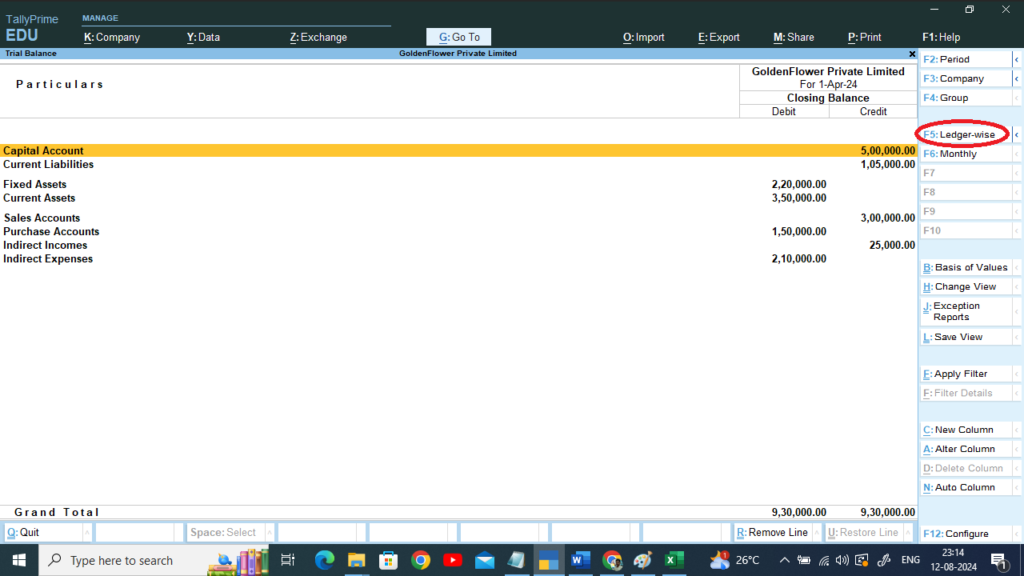

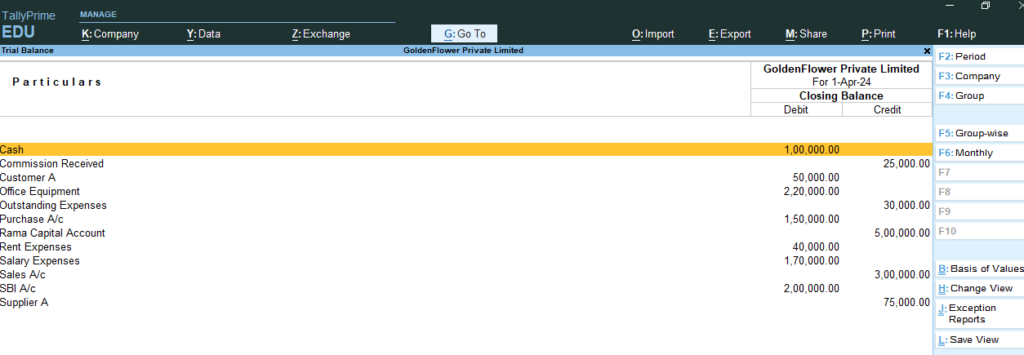

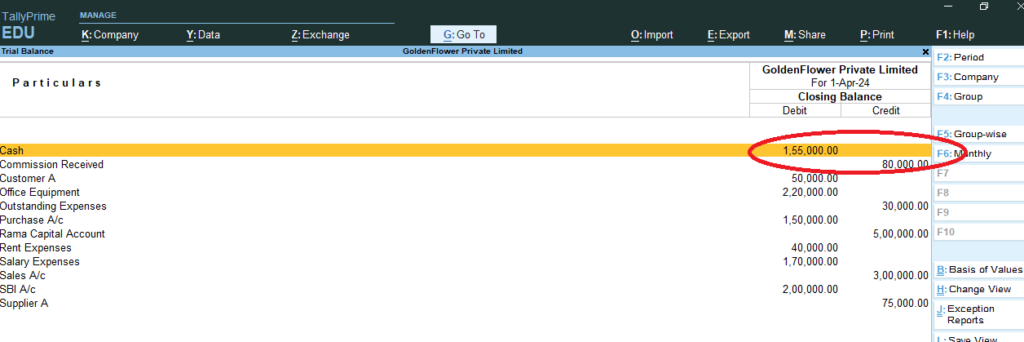

10. Go Gateway of Tally > Go Display More Reports or Press D > Go Trail Balance > and Press F5 (Ledger Wise / Group wise breakup)

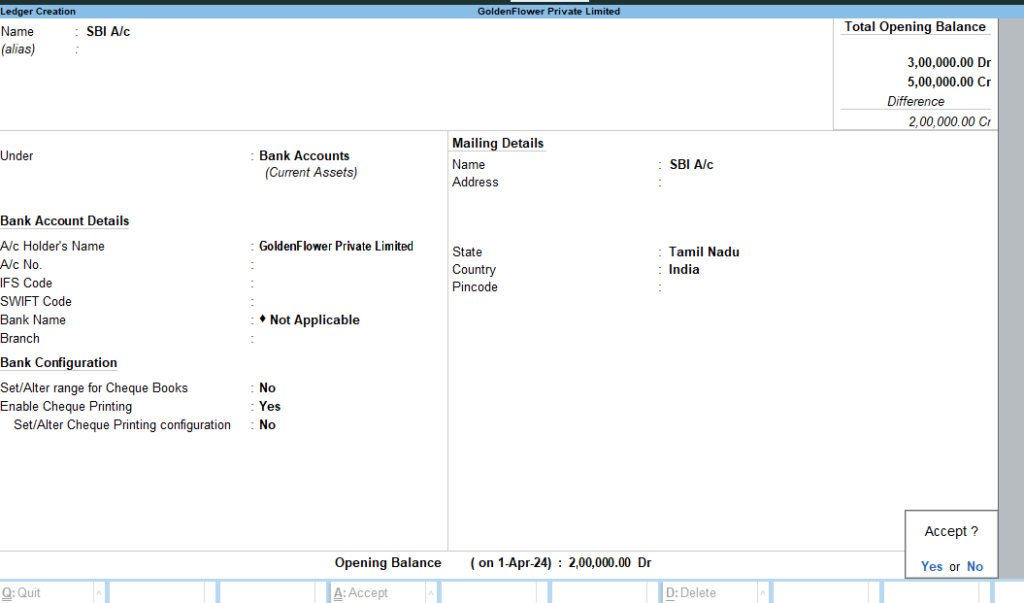

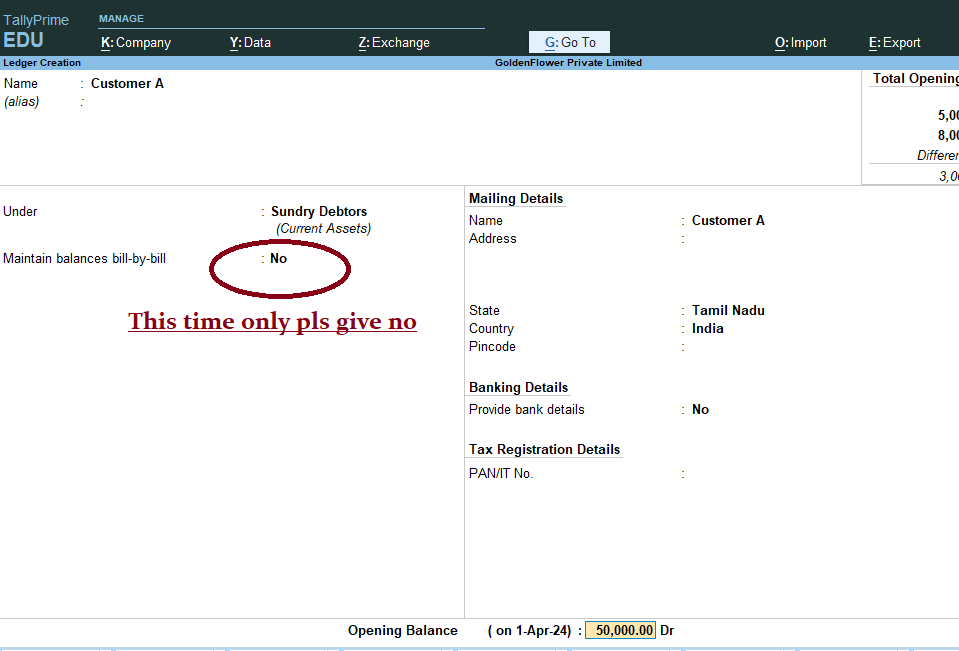

11. Now Add the following Ledger

| Ledger Name | Group | Debit (₹) | Credit (₹) |

|---|---|---|---|

| Cash Purchase A/c | Purchase | | 5000 |

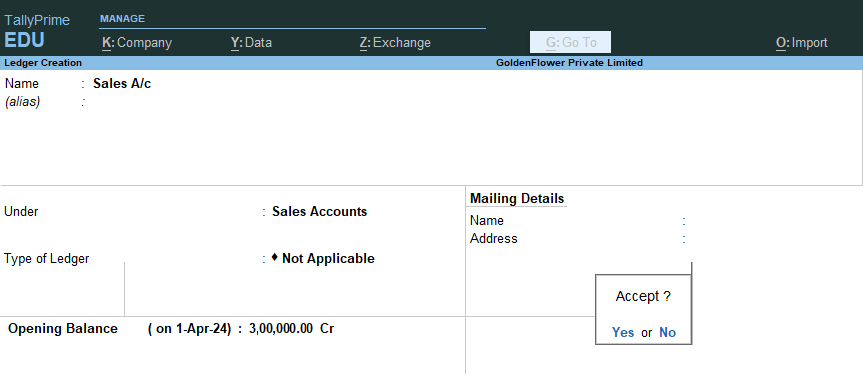

Go Gateway of Tally > Enter Name : Cash Purchase A/c — Under : Select Purchase Account > and Give Opening Balance : 5000 Cr. > Accept Yes >

Gateway of Tally > Master : Alter > Ledgers > Select Cash > Opening Balance : 5000 Dr. (Because Amount to be reduced due to Cash purchase Rs.5000)

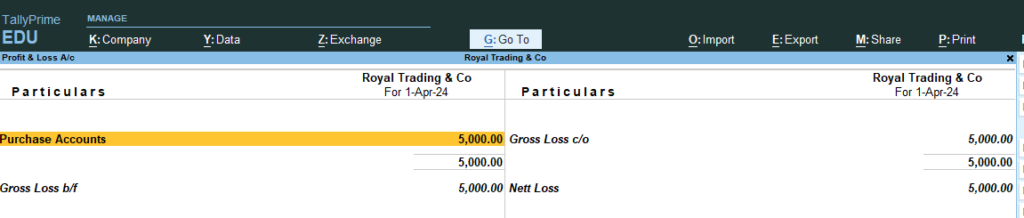

12. Now Go the Step No 8 , 9, 10 (See the changes in Profit and Loss and Balance sheet , now net loss Because Only Cash Purchase Not Sales ..)

13. Now Add the following Ledger

| Ledger Name | Group | Debit (₹) | Credit (₹) |

|---|---|---|---|

| Cash Sales A/c | Sales | 20000 |

Go Gateway of Tally > Master > Create : Ledgers > Enter Name : Cash Sales A/c — Under : Select Sales Account > and Give Opening Balance : 20000 Dr. > Accept Yes >

Gateway of Tally > Master : Alter > Ledgers > Select Cash > Opening Balance : 25000 Dr. (Because Amount to be raised due to Cash Sales Rs.20000)

14. Now Go the Step No 8 , 9, 10 (See the changes in Profit and Loss and Balance sheet)

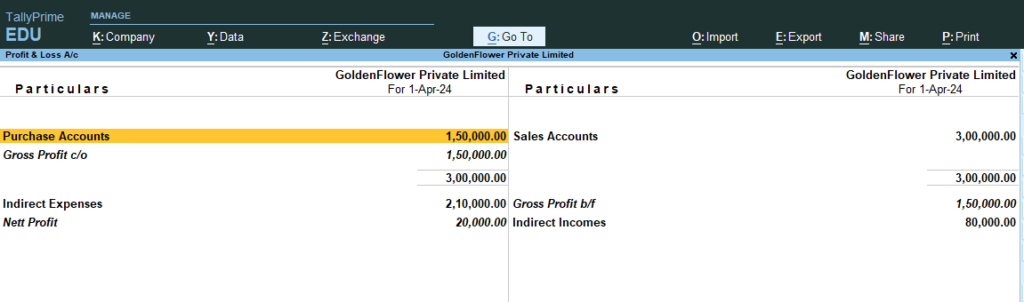

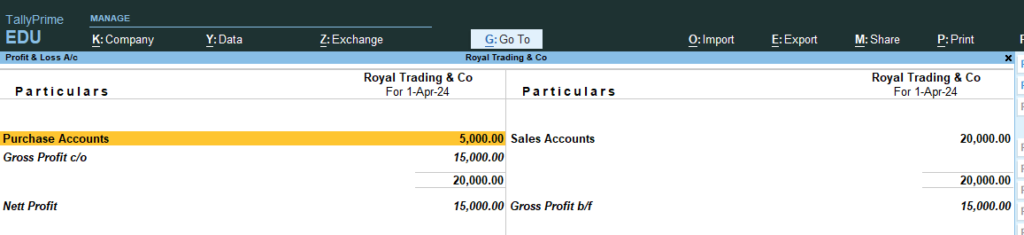

Profit and Loss A/c

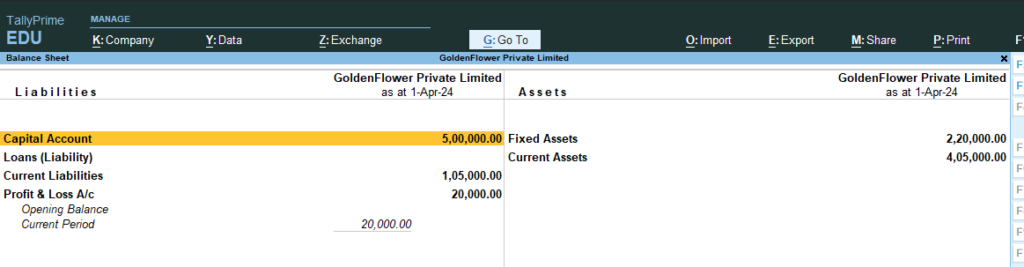

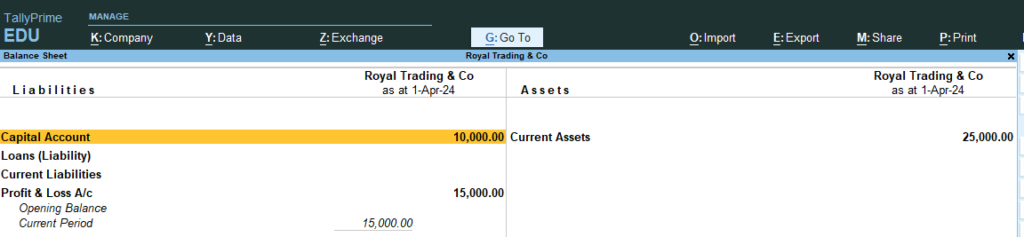

Balance Sheet

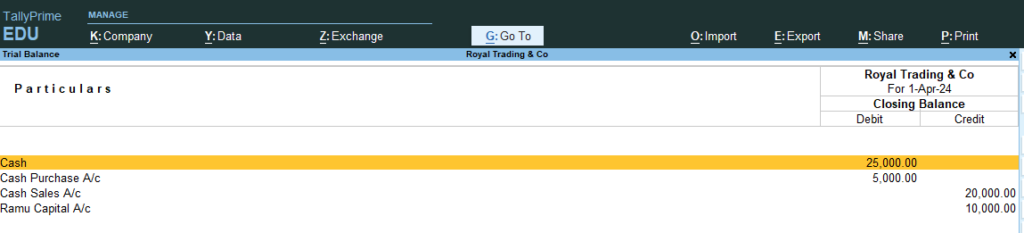

Trail Balance

13. Now Add the following Ledger

| Ledger Name | Group | Debit (₹) | Credit (₹) |

|---|---|---|---|

| Furniture | Fixed Asset | 5000 | |

| Telephone Charges | Indirect Expenses | 1000 | |

| Electricity Bill Paid | Indirect Expenses | 500 | |

| Total | 6500 |

14. Go Gateway of Tally > Master > Create : Ledgers > Name : Furniture — Under : Fixed Asset > and Give Opening Balance : 5000 Dr. > Accept Yes >

15. Name : Telephone Charges — Under : Indirect Expenses > and Give Opening Balance : 1000 Dr.

16. Name : Electricity Bill Paid — Under : Indirect Expenses > and Give Opening Balance : 500 Dr.

17, Gateway of Tally > Master : Alter > Ledgers > Select Cash > Opening Balance : 18500 Dr. (Because Amount to be reduced due to Expenses (25000- 6500 = 18500 Dr.)

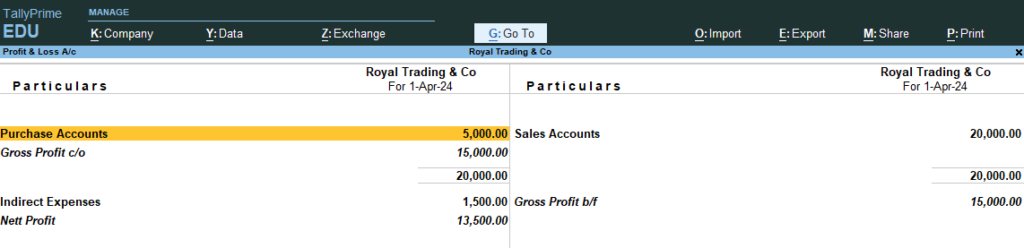

18. Now Go the Step No 8 , 9, 10 (See the changes in Profit and Loss and Balance sheet)

If any doubt say comments … thanks

Continue…..