Type of Accounts

- Personal Account -it represents people, businesses, or other organizations.

- State Bank of India A/c (Bank Name)

- Sri Ram Capital A/c (Investor)

- Raja A/c (Supplier Name)

- Kumar A/c (Customer Name)

- Real A/c – it Represents Goods (Items) and Assets

- Cash A/c ,

- Furniture A/c,

- Goods A/c

- Purchase of Goods A/c ( Purchase A/c)

- Sales of Goods A/c, (Sales A/c)

- Credit Sales A/c,

- Computer A/c,

- Machinery Purchase A/c ,

- Nominal A/c – It represents Income ,Gains,Expenses, Losses

- Rent Paid ,

- Salary Paid ,

- Telephone Charges

- Wages A/c ,

- Fees Received ,

- Interest Received

- Depreciation A/c , Etc.

- Sri Ram Started Business with a Capital of 50,000

- Sri Ram Capital A/c (Personal Account)

- Cash A/c (Real Account)

- Bought Computer for cash 10,000

- Computer A/c ( Real A/c)

- Cash A/c (Real A/c)

- Purchase Goods from Ramesh Rs.5000

- Purchase Goods A/c ( Real Accounts) – it represents Goods / Products/ Items

- Cash A/c (Real Account)

- Bought Goods from Ramesh A/c on credit for 10,000.

- Ramesh A/c (Person A/c)

- Credit Purchase A/c ( Real Account)

- Rs.2000 Deposited into SBI A/c

- SBI A/c ( Persona Accounts)

- Cash A/c (Real Accounts

- Telephone Charges Paid by Cash Rs.1500

- Telephone Charges (Nominal Account)

- Cash A/c ( Real Account

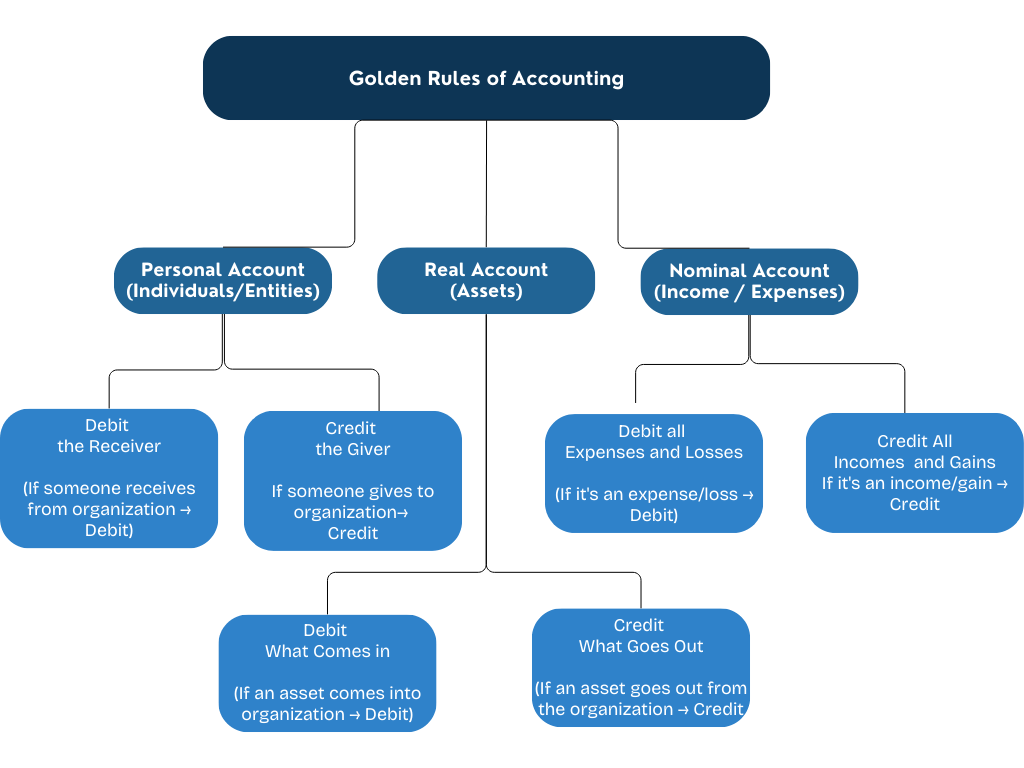

Golden Rules Accounts

- Personal Account – Debit the Receiver , Credit the Giver

- Real Accounts- Debit What Comes is – Credit what Goes Out

- Nominal Account- Debit All Expenses and Losses , Credit All incomes and Gains

Examples :

| Sri Ram Commenced Business with a Capital of 50,000. |

| Sri Ram Capital A/c | Cash A/c |

| Personal A/c | Real Account |

| Credit the Giver | Debit What Comes In |

| Cr. Sri Ram Capital A/c ……………. 50,000 | Dr. Cash A/c ……….. 50.000 |

| He Deposited into SBI A/c from Cash Rs.5000 |

| SBI A/c | Cash A/c |

| Personal A/c | Real Account |

| Debit the Receiver | Credit What Goes Out |

| Dr. SBI A/c ……………. 5,000 | Dr. Cash A/c ……….. 5,000 |

| Purchase Goods from Cash A/c Rs.1000 |

| Purchase Goods A/c | Cash A/c |

| Real A/c | Real Account |

| Debit What Comes into Business | Credit What Goes Out from Business |

| Dr. Purchase Goods A/c……………. 1,000 | Dr. Cash A/c ……….. 1,000 |

| Purchase Goods from Ganesh Supplier Rs.1000 |

| Purchase Goods A/c | Ganesh A/c |

| Real A/c | Personal Account |

| Debit What Comes into Business | Credit the Giver |

| Dr. Purchase Goods A/c……………. 1,000 | Dr. Ganesh A/c……….. 1,000 |

| Telephone Charges Paid from cash 1200 |

| Telephone Charges | Cash A/c |

| Nominal A/c | Real Account |

| Debit All Expenses and Losses | Credit What Goes Out from Business |

| Dr. Telephone Charges A/c……………. 1,200 | Cr. Cash A/c……….. 1,200 |

| Interest Received from SBI A/c 2500 |

| SBI A/c | Interest Received A/c |

| Personal A/c | Nominal Account |

| Debit the Receiver | Credit all Incomes and Gains |

| Dr. SBI A/c……………. 1,200 | Cr.Interest Received A/c……….. 2,500 |

| Paid to Ganesh (Supplier) – Rs. 1000 |

| Ganesh Supplier A/c | Cash A/c |

| Personal A/c | Real Account |

| Debit the Receiver | Credit What Goes Out |

| Dr. Ganesh Supplier A/c……………. 1,000 | Cr. Cash A/c……….. 1,000 |

Leave a Reply